In a rapidly evolving digital landscape, the tech industry continues to attract investors with its promise of innovation, disruption, and potential for massive returns. As we navigate through a world shaped by technological advancements, it begs the question: where is the money going in this ever-changing sector? Let’s delve into the latest investment trends in the tech industry and explore where investors are placing their bets for the future.

Investment Diversification: Exploring Emerging Tech Sectors

Investors are constantly seeking new opportunities to diversify their portfolios, and the tech industry offers a plethora of emerging sectors to explore. From artificial intelligence to biotech, there is no shortage of innovative fields attracting attention and capital. One trend that has been gaining momentum is investment in clean energy technology. As the world grapples with climate change, renewable energy sources such as solar and wind power are becoming increasingly popular among investors looking for sustainable options. Another area seeing significant growth is cybersecurity, as the frequency and sophistication of cyber attacks continue to rise, companies that specialize in protecting digital assets have become a hot commodity.

In addition to these sectors, there are also exciting opportunities in the field of quantum computing. With the potential to revolutionize industries such as finance, healthcare, and logistics, quantum computing companies are attracting significant investments from venture capitalists and large corporations alike. Furthermore, the rise of the Internet of Things (IoT) has created a new wave of opportunities for investors. With more devices connected to the internet than ever before, companies that specialize in IoT solutions are well-positioned to capitalize on this growing trend. As investors continue to seek out ways to diversify their portfolios, exploring these emerging tech sectors may prove to be a lucrative strategy.

Global Tech Hubs: Where to Look for Promising Startups

When it comes to investing in the tech industry, it’s crucial to keep a close eye on the global tech hubs where promising startups are emerging. These hubs serve as breeding grounds for innovation, creativity, and disruption in various sectors. By understanding the investment trends in these tech hubs, investors can make informed decisions on where to allocate their capital for maximum returns.

Some of the key global tech hubs to look out for when searching for promising startups include:

- Silicon Valley, USA

- Shenzhen, China

- Tel Aviv, Israel

- Bengaluru, India

- Berlin, Germany

Impact of Artificial Intelligence on Investment Strategies

In the fast-paced world of investment, the tech industry continues to be a hotbed of activity. With the rise of Artificial Intelligence (AI), investment strategies are shifting towards embracing the power of machine learning and data analytics. This trend is evident in the increasing focus on AI-driven algorithms that can analyze market trends, predict future outcomes, and make informed investment decisions.

Investors are now looking towards tech companies that are at the forefront of AI innovation. Companies such as Google, Amazon, and Microsoft are leading the way with their investments in AI research and development. These companies are not only shaping the future of technology but also influencing investment strategies in the tech industry. As AI continues to evolve and revolutionize the way investments are made, it is clear that the money is flowing towards companies that are leveraging the power of AI to drive growth and innovation.

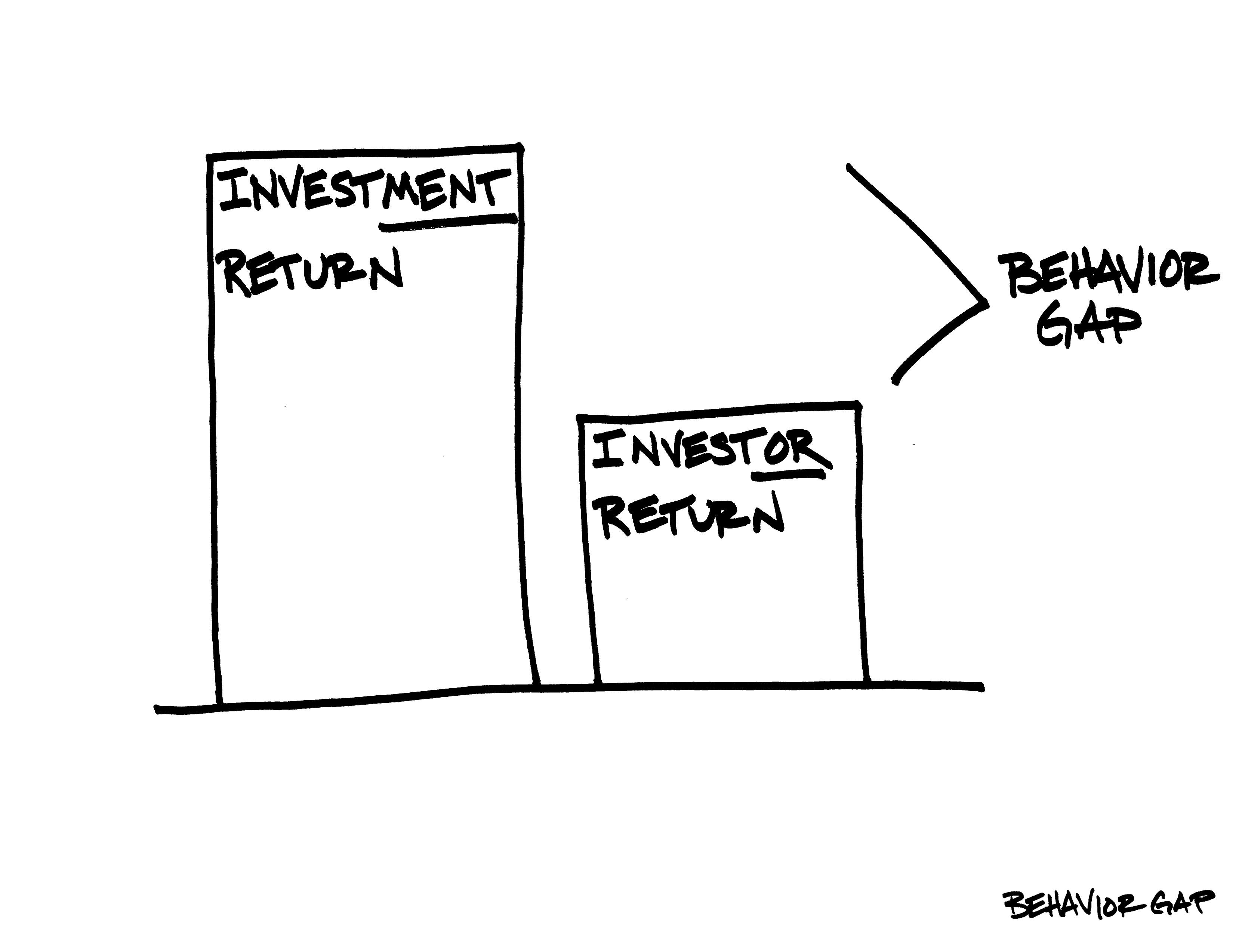

Robo-Advisors: Disrupting Traditional Investment Practices

With the rise of robo-advisors in the investment world, traditional practices are being disrupted like never before. These automated investment platforms use algorithms to provide personalized financial advice and portfolio management at a fraction of the cost of human financial advisors. This shift in the industry is attracting a new wave of tech-savvy investors who are looking for efficient and affordable ways to grow their wealth.

As more and more investors turn to robo-advisors, the tech industry is seeing a significant increase in funding for these disruptive startups. The money flowing into these platforms is a clear indication of the confidence investors have in the future of automated investing. With advanced technology and machine learning at their core, robo-advisors are revolutionizing the way people manage their finances and plan for the future.

Wrapping Up

As technology continues to evolve at a rapid pace, the investment landscape in the tech industry is always changing. From blockchain to artificial intelligence, where the money is going today may not be where it goes tomorrow. Keep an eye on emerging trends, disruptive innovations, and market shifts to stay ahead of the curve. The key to success in the tech industry is being adaptable, forward-thinking, and willing to take calculated risks. As we look towards the future, one thing is certain – the tech industry will continue to be a hotbed for investment opportunities. So, stay informed, stay agile, and most importantly, stay curious. The possibilities are endless.